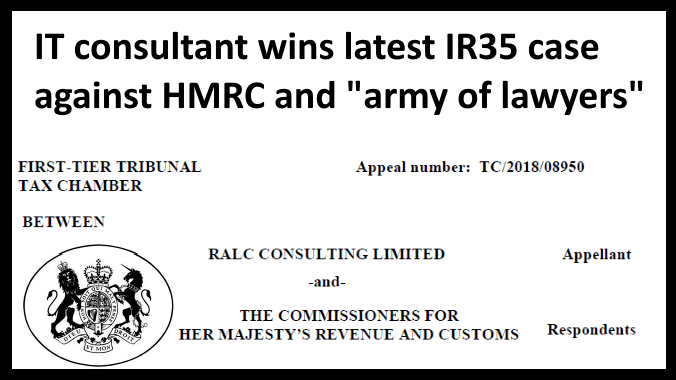

After a five year investigation, a professional IT consultant has defeated HMRC in an IR35 tribunal case which has again highlighted several of the taxman’s woeful failings and misconceptions concerning IR35.

IT contractor Richard Alcock successfully appealed his IR35 case against HMRC’s army of lawyers with a two man defence team led by tax expert Chris Leslie from Tax Networks, assisted by IR35 expert Dave Chaplin, CEO of ContractorCalculator, in what could be called a “Chris & Dave V Goliath” battle!

The appeal related to an HMRC-imposed tax bill concerning multiple engagements entered into by his limited company, RALC Consulting Ltd, between 2010 and 2015. This is in spite of a mob-handed approach by HMRC, which enlisted the help of a considerable number of barristers and lawyers.

- HMRC spends heavily on legal team, but evidence found lacking

- Case reaffirms importance of only being paid for work completed

- Taxman rejected ‘outside IR35’ assessments conducted using it's own CEST tool

- Tribunal Judge rejects HMRC’s flawed interpretation of mutuality of obligation

“The consulting rooms we resided in outside the court room were glass panelled, and at one point I counted almost a dozen people in HMRC’s room,” notes ContractorCalculator CEO Dave Chaplin, who assisted Chris Leslie of Tax Networks Ltd in representing Mr Alcock. “We were just the three of us, and clearly up against an army of lawyers.”

RALC v HMRC: what did the contracts say?

From 2010, Alcock entered into a series of contracts with former employer Accenture, and DWP, a client of Accenture’s whose projects Alcock had previously worked on. Despite having a prior relationship with his clients, Leslie explains that Alcock’s motives for entering the contract market were genuine:

“As a former Accenture employee, Richard was experienced in working alongside suppliers who provided services. Richard’s passion for delivery led him to make a move into contracting where he could choose which clients to work with and could fully focus on enabling their programmes.”

Despite this, it’s Alcock’s history which perhaps drew the attention of the taxman. His working history was central to the argument put forward by HMRC, which contested that his engagements subsequently implied an expectation of continued work.

However, this was dismissed by Tribunal Judge Rupert Jones, who noted: “The Tribunal does not accept HMRC’s submission that the long history of Mr Alcock’s previous engagement and operation of this contract in practice led to an expectation that Mr Alcock would be provided with work every business day during the course of an assignment, unless agreed otherwise, such that it crystallised into a legal obligation.”

This was determined based not only on the contractual terms, but also on their application in practice, acknowledging that in one contract with Accenture, the programme was stopped and therefore RALC's contract terminated early in January 2013, resulting in RALC not being paid for roughly 10 days work.

Whereas a substitute was never provided, Alcock was able to demonstrate how he had once arranged for a sub-contractor, only for the proposed contractor to instead accept an offer elsewhere. The tribunal ultimately accepted that Alcock’s engagements permitted him to provide a substitute, albeit a fettered one, because his clients were required to approve the selected worker.

HMRC’s evidence found lacking

Although HMRC clearly spent heavily by hiring two experienced barristers for the case, the evidence was simply lacking. Whereas eight individuals provided witness statements on behalf of Alcock, no cogent witness evidence was called upon by HMRC.

Instead, the taxman sought to rely on an uncorroborated HMRC written note of a January 2016 telephone conference call with Paul MacPherson, the project manager who Alcock worked alongside for “at most three months” during his contract with DWP.

The call between HMRC and MacPherson was to establish the operation of the contract. However, HMRC recorded no verbatim transcript, and despite being asked three times, MacPherson did not sign off the notes. Consequently, this evidence held little weight with the tribunal, with Judge Jones stating in his judgment: “His evidence is hearsay and filtered through the medium of an HMRC note taker.”

Ultimately, the conclusiveness with which the case was decided will no doubt raise further questions over the taxman’s judgement in spending taxpayer money defending a case which always looked like an impossible uphill battle.

“In my view, HMRC’s case was disproportionate, largely dependent on asserted facts involving uncorroborated and inaccurate information,” notes Leslie. "HMRC chose the facts and contractual clauses only when it suited them to do so. They were also given an opportunity to abandon this woeful case on several occasions, but chose not to do so. Consequently, the tribunal was put on notice concerning the unsavoury matter about wasted costs.”

“When I first got involved with the case in May 2018, I could not believe it was going to end up going to court,” adds Chaplin. “Richard was clearly a self-employed contractor, trying to run his own business, working on a project-by-project basis, and only getting paid for work done. How HMRC supposedly couldn’t fathom this is baffling.”

Contractor’s arrangements provided perfect blueprint for MOO

The outcome of the case rested largely on mutuality of obligation (MOO), with the tribunal accepting the submission concerning MOO put forward by Alcock’s team. This was published (Paragraph 451) in the decision, and reads:

“There is a very clear distinction here. And Mr Alcock is clearly self-employed, because he fits the latter sequence of events. He agreed the work to be done, and only that work to be done. Then he got to work, and worked very hard indeed to meet the outcome goals. And then he billed only for the work done. His contract specifically states that he can only charge for work actually completed. And to top it off, in one instance they did cut the project short at a moment’s notice, and he was not paid.

“There is no question at all that he could charge just for making himself available, and neither was the client obliged to give him work or allocate work – the work has already been agreed upfront.

“So, since there was no minimum obligation to provide work and no ability to charge for just making himself available, it is clear that the key elements of mutuality, in the work/wage bargain sense, are missing, and therefore he cannot be considered an employee.”

“What was described to, and accepted by, the tribunal was not only indisputable evidence that mutuality of obligation did not apply to Alcock’s engagements, but also the blueprint by which all contractors should seek to structure their arrangements,” highlights Chaplin.

HMRC’s MOO interpretation rebutted once more

Meanwhile, HMRC once again failed to convince the tribunal into accepting its blinkered interpretation of MOO. The taxman contested that the exchange of labour for remuneration was evidence of MOO and indicative of employment. However, this was rejected by Judge Jones, who observed:

“Although there was some mutuality of obligations in respect of the requirement for payment if work was done, it did not extend beyond the irreducible minimum in any contract to provide services nor demonstrate the relationship was one of a contract of service.”

This isn’t the first time the taxman’s interpretation of MOO has been dismissed by Judge Jones, who, when presiding over the case of Armitage Technical Design Services Ltd v HMRC, commented:

“HMRC’s case is that where one party agrees to work for the other in return for payment, then this satisfies mutuality of obligation between the two parties. That would be true of every contract, both employment and for services, otherwise the contract would not exist at all.”

Tribunal raises further causes for concern regarding CEST

HMRC’s often rejected argument is similarly used in attempts to justify the omission of MOO from its Check Employment Status for Tax (CEST) tool. For Chaplin, this latest outcome is further confirmation of CEST’s inadequacies:

“CEST does not consider MOO, and in this case it appears to have been determinative of the decision. For CEST to be fit-for-purpose and itself adhere to reasonable care, it clearly needs to include MOO. Unless this happens, the tool clearly contradicts what has been repeatedly confirmed by tribunal judges and should therefore be withdrawn immediately.”

However, judging from the tribunal, an inaccurate outcome isn’t the only risk one runs when using CEST. As part of his analysis, Chaplin was asked to conduct an assessment of Alcock’s engagements, to determine what decision CEST would arrive at when answered in accordance with the contracts and other written evidence – all of which was available to HMRC.

Each CEST assessment indicated that IR35 did not apply. Consequently, at a preliminary hearing, HMRC counsel unsuccessfully attempted to have the supporting analysis work omitted from consideration arguing, “the application of CEST to the appellant’s arrangements is irrelevant to the issues to be determined by the tribunal”.

The taxman’s readiness to dispute CEST is contrary to its public claims to stand by the determinations issued by the tool. It is also becoming a worrying trend for hiring organisations, with NHS Digital recently revealing it had suffered a £4.3m tax bill after HMRC had challenged its CEST assessments indicating an ‘outside IR35’ position.

“HMRC claims it will stand by the results of the tool, but overwhelming evidence now demonstrates that HMRC will only stand by its tool when it provides the result it wants – which is for everyone to be classed as a deemed employee,” says Chaplin.

Test of control decided in contractor’s favour

The element of control in relation to the engagements was also decided in Alcock’s favour, due to the tribunal’s conclusion that the ‘how’ or ‘what’ of his work wasn’t subject to sufficient control.

Whereas HMRC had theorised from its communication with MacPherson that Alcock’s time at DWP involved deputising for MacPherson by carrying out tasks on his behalf, this was rejected by the tribunal as an unfair reflection of the position held.

Elsewhere, Judge Jones confirmed that Alcock’s work was project-based, stating: “The Tribunal has found that Mr Alcock’s assignments were to deliver pieces of work rather than simply to occupy the specified role so that it was the performance and delivery that controlled the nature of his work rather than the job title.”

Though it was acknowledged that there was a degree of control over "when and where" Alcock provided his services, Judge Jones noted “this was necessary to provide a quality of service for his clients”, adding: “Mr Alcock’s substantial level of control over how he provided his services was provided for as a matter of right in his contracts and exercised in practice.”

How Leslie and Chaplin beat the Goliath of HMRC

Ultimately, for all HMRC’s legal power, a careful and considered presentation of the facts was enough to determine in Alcock’s favour a case which realistically should never have made it to tribunal.

“There was an inequality of arms that we faced throughout proceedings,” comments Leslie. “As for Dave Chaplin, he was a complete star and I’m so glad how the three of us operated as a team.”

“It was an arduous three days in court, with just the two of us defending,” adds Chaplin. “We also had to work until the very early hours of each morning, trying to prepare for the next day. Contrast that with HMRC, who had an army of barristers and lawyers working for them.

“For example, on the morning of day three, they delivered a lengthy document which picked out and summarised key facts from the first two days of hundreds of pages of typed transcripts produced by the stenographers. We hadn’t even had time to go through the transcripts in that level of detail, let alone compile a similar document of favourably picked findings.

“Prior to me joining the team, Chris had already completed an exemplary fact find, which formed the solid foundation for the appellants defence. So, whilst Chris and I appeared to be heavily out-gunned in court, we were confident in the underlying facts of the case. Richard came across very well at a witness and clearly explained how he worked as a self-employed IT contractor.”

What’s next for HMRC and the contract sector?

Though it will be unhappy with the decision, the omens don’t look good for HMRC if it is to appeal the outcome. Particularly since Alcock’s latter contracts were a carbon copy of the Jensal Software Ltd v HMRC case, which itself was a decisive victory for the contractor.

Also, with the case having been presided over by Upper-Tribunal (UT) Judge Rupert Jones, it is unlikely that an appeal to the UT would yield a different outcome, unless HMRC was able to claim significant errors in law were made in the decision.

The irony for HMRC is that if it were to launch a successful appeal, there would be no tax to collect, due to the damage HMRC has caused financially and reputationally, RALC is now in significant debt and had to terminate two permanent staff and other contractors. Alcock has paused contracting and is now considering permanent employment as a result of the taxman’s aggressive pursuit of him:

“Ironically, I will generate far less tax for HMRC as an employee, but the whole sorry episode has clouded my view of contracting,” says Alcock. “Why does HMRC hate contractors so much? I cannot tell you how angry I am at the stress and pressure their relentless pursuit, for five years, put me and my family under. It was hell."

“Despite winning RALC is now effectively doomed, and Richard’s dreams of building his own business are shattered by the taxman’s harassment,” adds Chaplin. “This is where we are, and this is a stark reminder of the damage done by an out of control HMRC.”

“This has been said many times before, but HMRC should now focus on using the legislation in the manner it was intended by Parliament – to crackdown on contrived situations where tax avoidance is present. In this instance, all it has done is waste taxpayer money chasing a meritless case, shattering the dreams of a small business person who wanted to better himself and start his own business.”

The ruling is also hugely important for the contracting sector. With the Off-Payroll rules approaching, many private sector firms are indicating that they will not engage limited company contractors, or consultancies providing limited company contractors. However, as Chaplin highlights, this case illustrates how ‘outside IR35’ compliance can be achieved:

“This ruling clearly demonstrates how the contractor hiring policies of companies should be formed in order to avoid falling foul of IR35. The case essentially provides a blueprint for firms to operate compliantly. HMRC and the Treasury have always stated that the Off-Payroll rules should not affect the genuinely self-employed. This case demonstrates this, despite HMRC’s best efforts.”